In the fast-paced world of cryptocurrency trading, understanding the roles and dynamics of market makers and market takers is crucial for both new and seasoned investors. These two types of market participants play a fundamental role in ensuring liquidity, facilitating trades, and ultimately contributing to the market’s overall health and efficiency. This article delves into the functions, benefits, and differences between market makers and market takers, offering insights into their impact on the cryptocurrency markets.

The Role of Market Makers

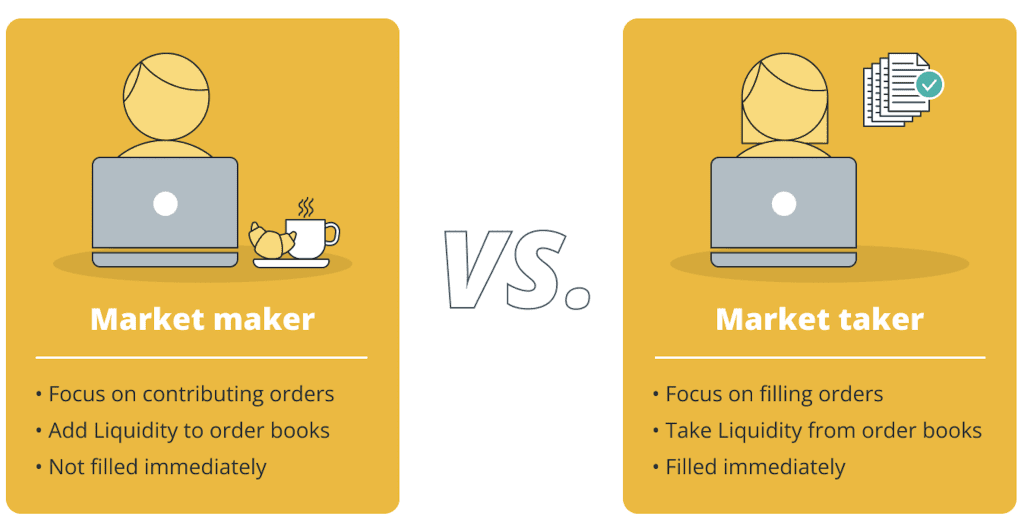

Market makers are entities or individuals that provide liquidity to the market by continuously offering to buy and sell cryptocurrencies. They quote both a buy (bid) and a sell (ask) price, effectively making a market for traders. The presence of market makers reduces the bid-ask spread—the difference between the buying and selling prices—which benefits the market by making it easier and more efficient for participants to execute trades.

Market makers profit from this spread, aiming to buy low and sell high. They bear the risk of holding a certain amount of cryptocurrencies in their inventory, which they manage through various strategies, including hedging and sophisticated trading algorithms. Many operate electronically, leveraging algorithmic trading to adjust their quotes in real-time based on market conditions.

Furthermore, market makers often foster close relationships with cryptocurrency exchanges. They may provide liquidity to specific trading pairs, and in return, exchanges may offer incentives to encourage their participation. This collaboration enhances the attractiveness of an exchange by ensuring a high level of trading activity and market efficiency.

The Role of Market Takers

Market takers, on the other hand, are individuals or entities that execute trades against the orders placed by market makers or other participants. They “take” liquidity from the market by matching their trades with existing orders on the order book. Market takers typically use market orders, which are executed immediately at the best available price, prioritizing speed over price.

Market takers are essential for the dynamism of the market, reacting swiftly to changing market conditions. They pay a higher transaction fee than market makers, as their activities remove liquidity from the market. Despite this cost, the role of market takers is vital in ensuring that trades can be executed promptly, enabling a fluid market environment.

Market Makers vs. Market Takers: Key Differences

- Liquidity Contribution vs. Consumption: Market makers add liquidity to the market by placing orders that are not immediately filled, while market takers consume liquidity by filling orders already present on the order book.

- Fees: Market makers often enjoy lower fees on exchanges due to their role in providing liquidity. Market takers, however, usually incur higher fees as their trading activities consume liquidity.

- Trading Strategy: Market makers employ strategies to profit from the bid-ask spread and must manage the risk of holding inventory. Market takers prioritize immediate execution, willing to accept the prevailing market prices for this convenience.

The Impact of Crypto Whales

Crypto whales, or individuals/entities holding significant amounts of cryptocurrency, can act as both market makers and market takers. Their large trades can influence market dynamics significantly. As market makers, whales contribute to liquidity and stability, while as market takers, they can cause price slippage and volatility due to the size of their orders relative to the market’s liquidity.

Conclusion

Market makers and market takers play complementary roles in the cryptocurrency market, each contributing to its liquidity and efficiency. Understanding the differences between these two types of market participants is essential for anyone involved in crypto trading, as it sheds light on the underlying mechanics that drive market dynamics. As the crypto market continues to mature, the interplay between market makers and takers will remain a central theme in the quest for a more liquid and efficient market.

Do Your Own Research: This overview is for informational purposes only and should not be considered financial advice. Always conduct thorough research and consider your investment strategies before participating in the cryptocurrency market.