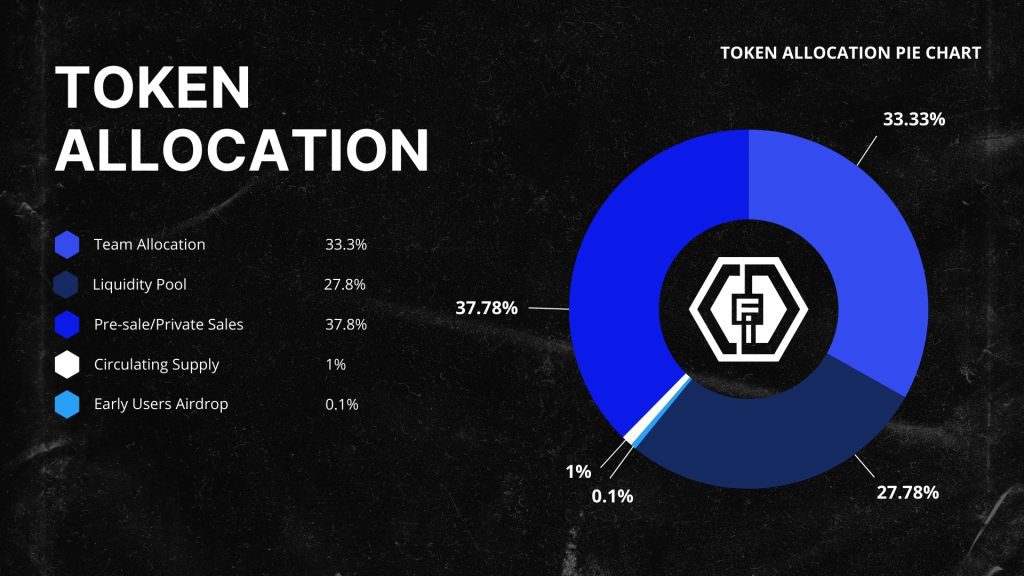

Token Allocation

Token Contract on @Uniswap: 0x527856315a4bCD2F428EA7fA05ea251f7e96A50A

🔗 https://github.com/CeDeFiAI/cedefi-contracts/tree/main/contracts/utils

- Max Supply: 200M $CDFI

- TGE Circulating Supply: 1.11% (2,222,220 $CDFI)

- Team Allocation: 66,666,666 tokens, now with a 48-month linear vesting period. 🔗 🔗https://polygonscan.com/tx/0xaa7dc50c4f07f163566aa28031103afb47e3167a440b3257597bfa6f6afcb22f

- Liquidity Pool: 55,555,555 tokens, 3-month cliff & 24-month linear vesting from 1/7/24. 🔗https://polygonscan.com/tx/0x316bd9e5d34d4a55e57e6ed2a5da409365666050676b46d6ab2a3d6c3c3133a8

- Pre-sale/Private Sales: 75,555,557 tokens, locked until 01/05/24. Post-lock, tokens will be transferred to investors’ vesting wallets. 🔗https://polygonscan.com/tx/0x4dedc5f2042d28be5f47bc9640b0d3217fba86ea31c3351ed0c9893bb2d40281

- Circulating Supply: 2,000,000 $CDFI, 1%

- Early Users Airdrop: 222,224 $CDFI, 0.111%

- Cross-Chain on 17 EVM Networks: Featuring @AxelarNetwork for seamless services, currently on BNB, ETH, POLYGON. More soon! 🔗https://interchain.axelar.dev/polygon/0x527856315a4bCD2F428EA7fA05ea251f7e96A50A

Token use cases:

- Staking for Access: Users can stake the CDFI.AI token to access the platform paid features. Upon staking, the token is locked for a designated period, possibly incurring a small usage fee.

- Income Pool Staking: Token holders can stake their to enjoy platforms income pools shares dedicated to motivate our investors to HODL.

- Governance: Token holders can partake in platform decision-making, ensuring the ongoing evolution and integration within the platform.

- Cross-Chain Transfer on 17 EVM Networks: Featuring the Axelar Network for seamless services, currently on BNB, ETH, POLYGON. (TBA)

- Discounts: Users who choose to pay for our services in $CDFi token will enjoy additional discounts on our services.

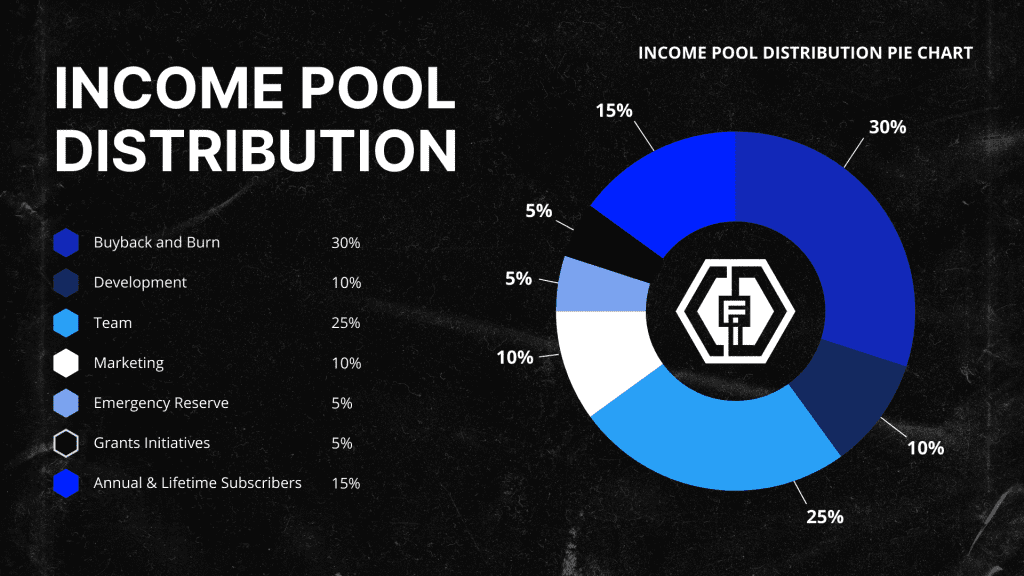

Income Pool Dynamics in CeDeFiAi

Formation of the Income Pool:

The foundation of the income pool draws from multiple avenues within CeDeFiAi. It amalgamates revenues from subscription tiers, sales within the marketplace, and other revenue-generating channels on the platform.

Advantages of the Income Pool:

- Rewarding Stakeholders: The income pool amplifies CeDeFiAi’s appeal for all involved parties. From token holders to subscribers, everyone can anticipate added bonuses and perks, which are in sync with the platform’s trajectory.

- Stimulating Community Engagement: Community grant initiatives are designed to cultivate an active and collaborative environment. This approach not only bolsters participation but also sparks innovation within the ecosystem.

- Enhancing Token Value: Through the buyback and burn strategy, the CDFi token is rendered scarcer, potentially boosting its value over time.

Distribution Allocation:

- Buyback and Burn: 30%

- Development: 10%

- Team: 25%

- Marketing: 10%

- Emergency Reserve: 5%

- Grants Initiatives: 5%

- Annual & Lifetime Subscribers: 15%

This addition showcases how CeDeFiAi integrates diverse revenue streams to form an income pool, then strategically allocates its resources to ensure both growth and stakeholder rewards. This approach is a testament to CDFI.AI’s commitment to value generation and community enrichment.