The Pro Trade Terminal from CeDeFiAi operates through a complex and integrated process to deliver sophisticated trading services to users:

Asset or Pack Selection: On entering the terminal, users can choose to trade either a single asset or a pack (portfolio). For pack trading, users can specify and predefine the weight of each asset within the pack. This weight acts as the parameter for the trade amount.

Trade Amount Determination: Users then decide on the investment amount for either the chosen asset or the entire pack.

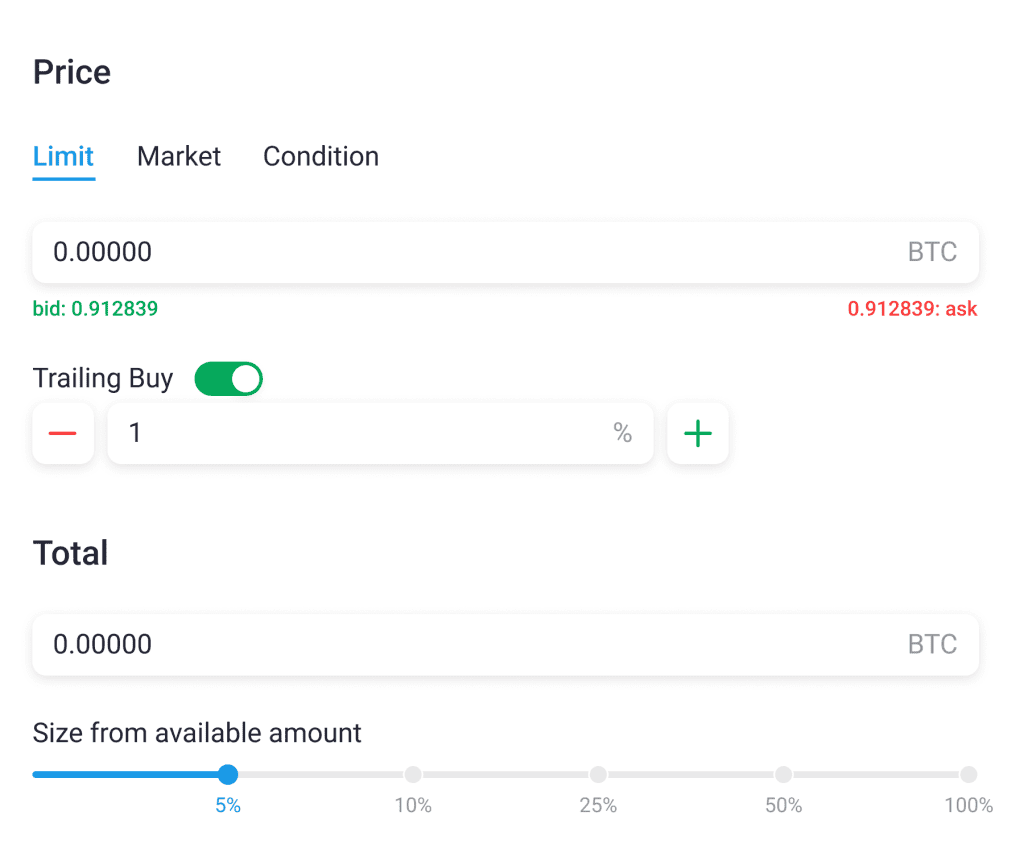

Order Condition: Users set the order condition next. The options include market, limit, or signal-based (via webhook) orders.

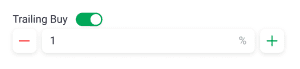

Trailing Buy/Sell: Users can opt for a trailing buy or sell order. For instance, if a user wants to buy an asset currently priced at 1 but anticipates a drop to 0.9, they can set a trailing order with a retrace percentage. The bot executes the order when the asset’s price meets the retracement criteria.

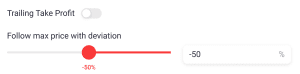

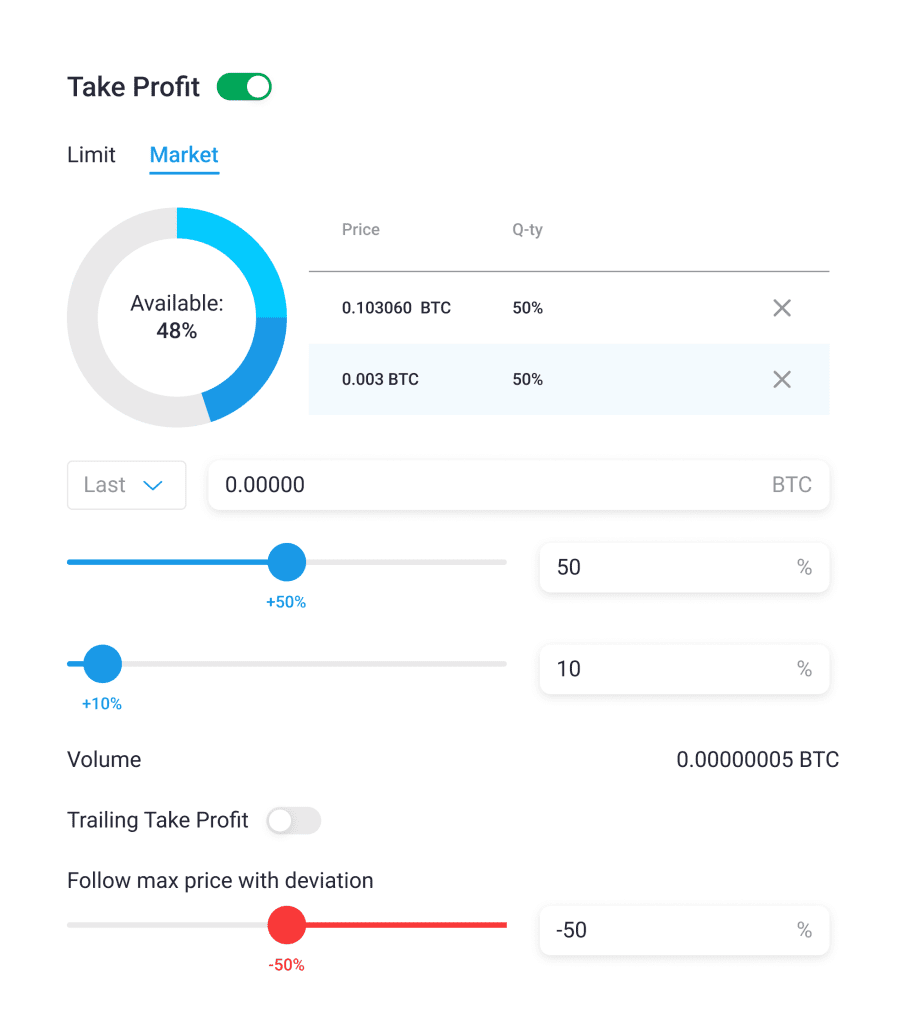

Take Profit Parameters: Users then define their take profit parameters. Options include a simple take profit, split take profit targets, or a trailing take profit. Additionally, the terminal provides a ‘Grid Profit’ option, which involves a bot that executes buys and sells within a user-defined range.

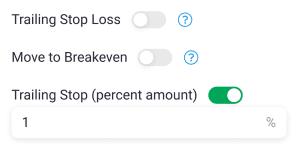

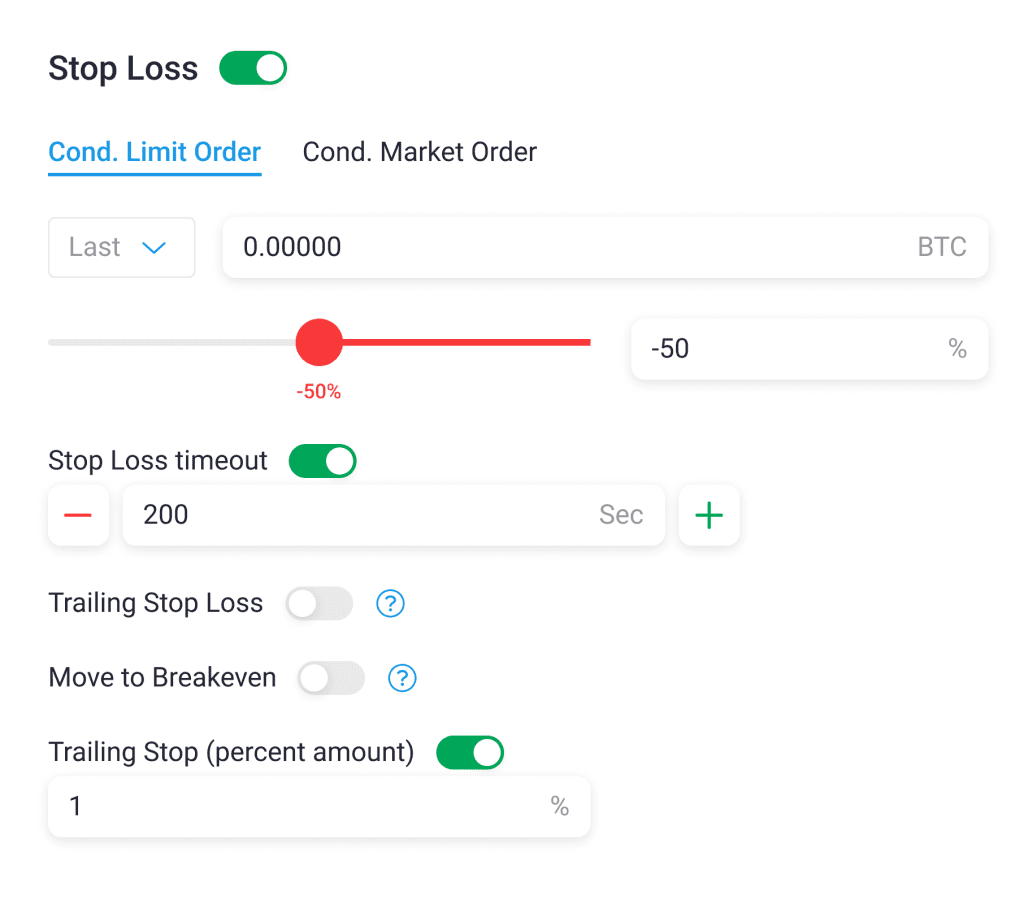

Stop Loss Parameters: Subsequently, users set their stop loss parameters. They can opt for a regular stop loss, trailing stop loss, or a move to break-even stop loss.

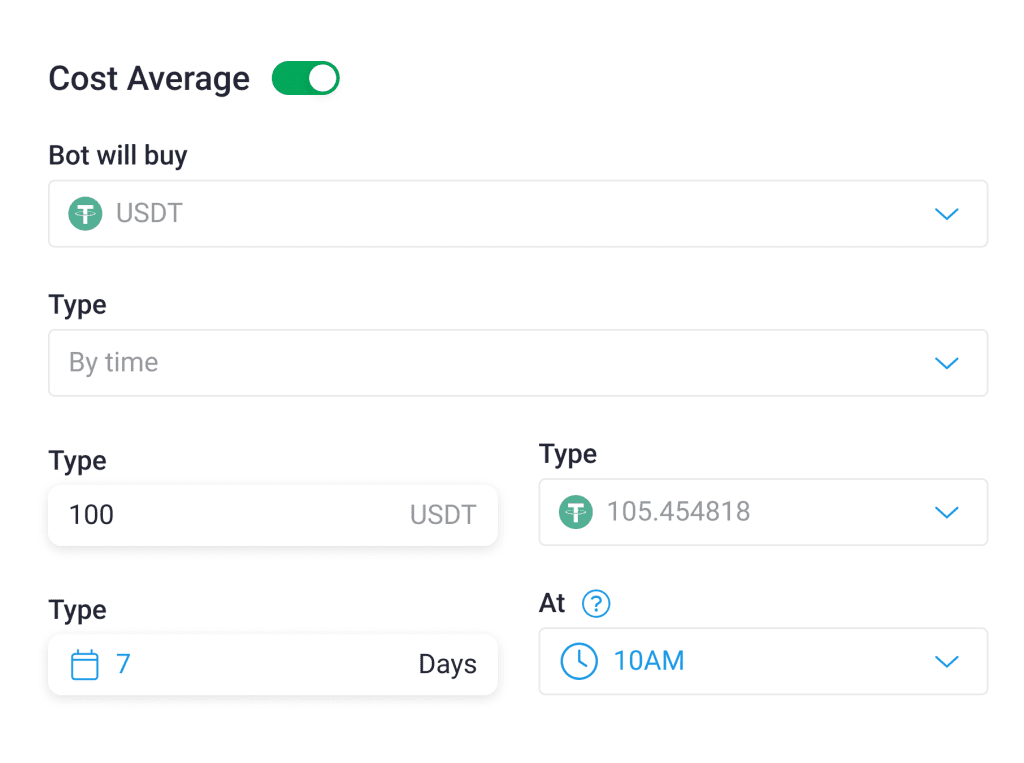

Dollar-Cost Averaging (DCA) Parameters: After finalizing the general parameters, users can choose to implement a Dollar-Cost Averaging (DCA) strategy. This can be set to trigger by time or by a percentage change, and applies to either the selected asset or the entire pack.

This comprehensive process encapsulates the capabilities of CeDeFiAi’s Pro Trade Terminal, offering a technically advanced platform that gives users the tools to create nuanced and sophisticated trading strategies.